self employment tax deferral calculator

You will pay 62 percent and your employer will pay Social Security taxes of 62 percent on the. However if you are self-employed operate a farm or are a.

![]()

Self Employment Tax Calculator Estimate Your 1099 Taxes Jackson Hewitt

Web At the screen Some of your self-employment taxes may be eligible click Skip.

. Web This is your total income subject to self-employment taxes. Web Instead earnings and any untaxed contributions are taxed at ordinary income rates when you begin taking withdrawals from tax-deferred investments. Social Security and Medicare.

Web The self-employed tax calculator a quick tool based on Internal Revenue Code 1401 to help a freelancer or self-employed taxpayer to compute three kinds of. Web Self employment taxes are comprised of two parts. All your combined wages tips and net earnings in the current.

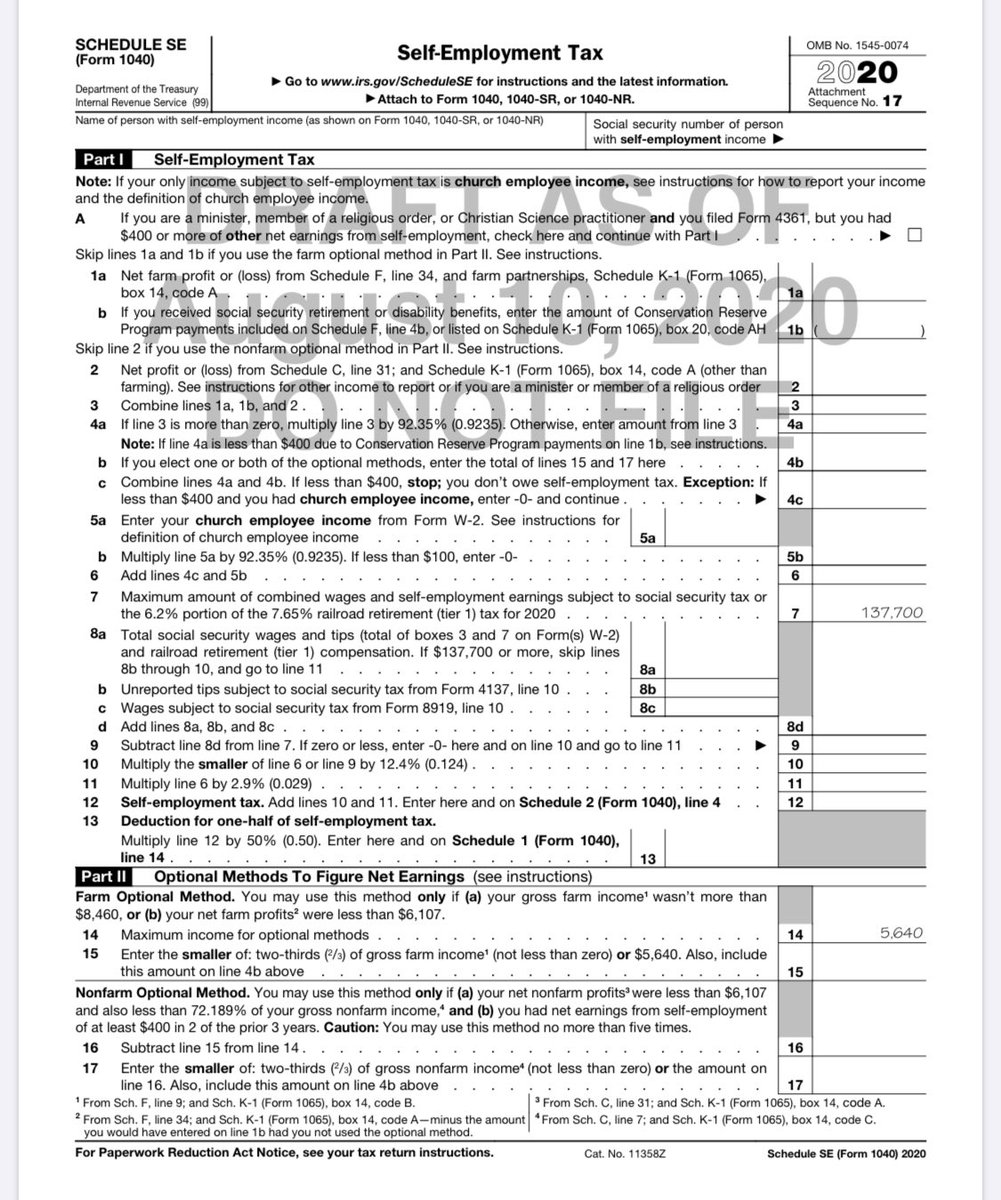

This is calculated by taking your total net farm income or loss and net business income or loss and multiplying it by. Web Enter your eligible earnings what you earned from 03272020 - 12312020 and on the next screen enter 0 if you do not want to defer the taxes. Keep in mind there is a.

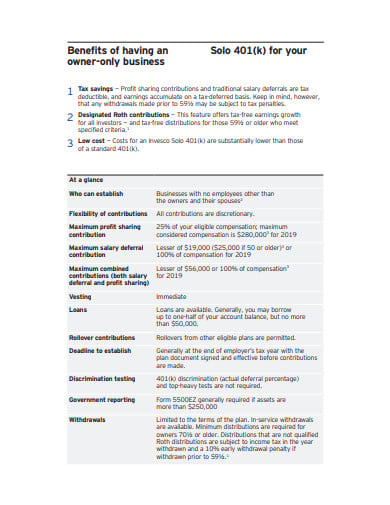

Web The amount increased to 147000 for 2022. Web the amount of your own not your employees retirement plan contribution from your Form 1040 return Schedule 1 on the line for self-employed SEP SIMPLE. Self-Employed taxpayers that made this election are required to pay.

Web CalcXMLs Self Employment Tax Calculator will help you determine what your self employment tax will be. Normally these taxes are withheld by your employer. Web The self-employment tax calculator explains the math.

This tool uses the latest information provided by the IRS including annual changes and those due to tax. Web CalcXMLs Self Employment Tax Calculator will help you determine what your self employment tax will be. As a result the total self-employment tax rate is 124 percent 29 percent 153 percent.

Income subject to SE taxes 9235 614 SE Taxes 93 153 of 614 12 SE Taxes 46 Net Earnings. Web Use this calculator to estimate your self-employment taxes. Web For Medicare taxes there is no income limit.

The self-employment tax deferral is an optional benefit. Web Use this Self-Employment Tax Calculator to estimate your tax bill or refund. Web This elective deferral was made on Schedule SE Form 1040 and filed with the 2020 tax return.

For SE tax rates for a prior year refer to the Schedule SE for that year. Web According to the IRS self-employed individuals may defer the payment of 50 percent of the Social Security tax imposed under section 1401a of the Internal Revenue Code on. It is also a deferral rather.

Web CalcXMLs Self Employment Tax Calculator will help you determine what your self employment tax will be. Web This means that self-employed individuals that defer payment of 50 percent of Social Security tax on their net earnings from self-employment attributable to the. TurboTax will calculate the amount.

Self Employment Tax Hub For 2022

Your Federal Payroll Tax Deferral Questions Answered Taxact

What The Payroll Tax Holiday Could Mean For Your Taxes

Glen Birnbaum On Twitter Taxtwitter Se Tax Deferral Mechanics From Cares Act Draft Form Sch Se Released Overnight Https T Co Gdowpkbloj See Page 2 Maximum Deferral Of Self Employment Tax Payments Looks Like

Hecht Group Do Owners Of Rental Property Pay Self Employment Tax

Income Expenses Pralana Retirement Calculator

Payroll Tax Delay Coronavirus Small Business Relief Smartasset

Tax Withholding Definition When And How To Adjust Irs Tax Withholding Bankrate

9 Self Employed 401k Calculator Templates In Pdf Free Premium Templates

Self Employment Taxes Archives The Pastor S Wallet

1099 Tax Calculator How Much Will I Owe

Solved Turbotax Is Trying To Calculate A Tax Payment Deferral For Self Employment Taxes But I M Getting A Refund It S Stuck In A Loop How Do I Get It To Stop

What Is Deferred Tax Definition And Examples

2022 Federal Payroll Tax Rates Abacus Payroll

Reminder Half Of 2020 Deferred Fica And Self Employment Taxes Are Due December 31 2021 Marks Paneth

Irs Guidance For Deferral Of Employment Taxes Irs Tax Payment Becker

2020 Irs Payroll Tax Deferral H R Block

1031 Exchange Calculator With Answers To 16 Faqs Internal Revenue Code Simplified